Yes, your Wells Fargo Bank money market accounts are insured up to $250,000 per person by the Federal Deposit Insurance Corporation (FDIC). The FDIC is an independent agency of the United States government that protects you against the loss of your insured deposits if an FDIC-insured bank or savings association fails. Money Market Deposit Accounts are insured and allow you earn higher dividends as your balance increases. Open with a $2,000 minimum deposit Get a dividend rate as high as 0.35% APY. UNLIMITED in-person withdrawals and transfers. It may be insured and secured. Unlike money invested in stocks and bonds or other investment.

- Money Market Deposit Account Regulations

- Chase Money Market Deposit Accounts

- Money Market Deposit Account Risk

- Money Market Deposit Account

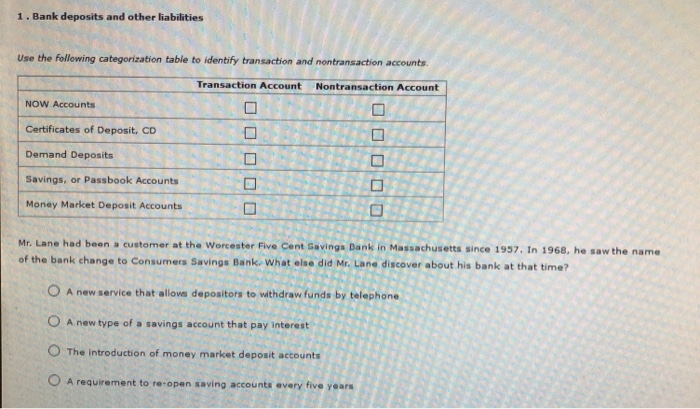

When you go to a bank to open a new account, you will have a variety of account types and features to choose from. Should you choose the basic checking option or an account that earns interest? Do you want the convenience of a bundled checking and savings account or the higher returns of a money market account?

A money market account is a type of savings deposit account that can be found at banks and credit unions. These high-rate money market accounts may pay a higher interest rate than traditional. Retirement Sweep Deposit Account: RSDA: Sweeps cash balances into E.TRADE's affiliated banks, E.TRADE Savings Bank and E.TRADE Bank: 0.01%: FDIC-insured up to $500,000 4 check View details: JPMorgan US Government Money Market Fund, Capital Class: OGVXX: A money market mutual fund seeking high current income with liquidity and stability of principal.

To make these decisions, it’s helpful to first understand the differences between the most common bank account types. Here are some definitions to help you navigate your banking needs:

- Checking account: A checking account offers easy access to your money for your daily transactional needs and helps keep your cash secure. Customers can typically use a debit card or checks to make purchases or pay bills. Accounts may have different options to help avoid the monthly service fee. To determine the most economical choice, compare the benefits of different checking accounts with the services you actually need.

- Savings account: A savings account allows you to accumulate interest on funds you’ve saved for future needs. Interest rates can be compounded on a daily, weekly, monthly, or annual basis. Savings accounts vary by monthly service fees, interest rates, method used to calculate interest, and minimum opening deposit. Understanding the account’s terms and benefits will allow for a more informed decision on the account best suited for your needs.

- Certificate of Deposit (CD): Certificates of deposit, or CDs, allow you to invest your money at a set interest rate for a pre-set period of time. CDs often have higher interest rates than traditional savings accounts because the money you deposit is tied up for the life of the certificate – which can range from a few months to several years. Be sure you do not need to draw on those funds before you open a CD, as early withdrawals may have financial penalties.

- Money market account: Money market accounts are similar to savings accounts, but they require you to maintain a higher balance to avoid a monthly service fee. Where savings accounts usually have a fixed interest rate, these accounts have rates that vary regularly based on money markets. Money market accounts can have tiered interest rates, providing more favorable rates based on higher balances. Some money market accounts also allow you to write checks against your funds, but on a more limited basis.

- Individual Retirement Accounts (IRAs): IRAs, or Individual Retirement Accounts, allow you to save independently for your retirement. These plans are useful if your employer doesn’t offer a 401(k) or other qualified employer sponsored retirement plan (QRP), including 403(b) and governmental 457(b), or you want to save more than your employer-sponsored plan allows. These accounts come in two types: the Traditional IRA and Roth IRA. The Roth IRA offers tax-free growth potential. Investment earnings are distributed tax-free in retirement, if the account was funded for more than five years and you are at least age 59½, or as a result of your death, disability, or using the first-time homebuyer exception. Traditional IRAs offers tax-deferred growth potential. You pay no taxes on any investment earnings until you withdraw or “distribute” the money from your account, presumably in retirement. Both types of IRAs offer investment flexibility, tax advantages, and the same contribution limits. You may want to discuss which type is best for you with your tax advisor before choosing your account.*

Money Market Deposit Account Regulations

Once you understand the types of accounts most banks offer, you can begin to determine which option might be right for you.

Tip

- Basic Finances,

Skip

Correct!

Money Market Savings. You may write checks on some money market accounts, but typically on a more limited basis than a checking account.

Incorrect.

Chase Money Market Deposit Accounts

Money Market Savings. You may write checks on some money market accounts, but typically on a more limited basis than a checking account.

Empower yourself with financial knowledge

We’re committed to helping with your financial success. Here you’ll find a wide range of helpful information, interactive tools, practical strategies, and more — all designed to help you increase your financial literacy and reach your financial goals.

Products to Consider

*Traditional IRA distributions are taxed as ordinary income. Qualified Roth IRA distributions are not subject to federal income tax provided a Roth IRA has been open for more than five years and the owner has reached age 59½ or is disabled, using the first time home-buyer exception or taken due to their death. Both may be subject to an IRS 10% additional tax on amounts subject to income tax if distributions are taken prior to age 59½.

Money Market Deposit Account Risk

Investment and Insurance Products are:- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

Money Market Deposit Account

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

LRC-0221